Key Challenges Businesses Face

Delayed Collection

Late invoices disrupt cash flow and increase financial uncertainty.

Inefficient Follow-Ups

Lack of structured payment reminders leads to missed collections.

Dispute Resolution Challenge

Managing accounts receivable in-house can be costly and time-consuming.

Credit Risks

Poor credit assessment can result in bad debts and revenue losses.

What We Offer

Know more about our Accounts Receivable Outsourcing Services

How Your Business Benefits

Faster

Payments

Improve cash flow with

optimized collection

strategies.

Lower

Costs

Save time and reduce

overhead by leveraging our

accounts

receivable outsourcing services.

Stronger Financial

Stability

Gain visibility into

receivables and reduce

bad debt risks.

Enhanced Customer

Relations

Maintain professionalism

while ensuring timely

payments.

Frequently Asked Questions

Accounts receivable outsourcing involves delegating invoice management, payment tracking, follow-ups, and collections to a specialized provider. This helps businesses improve cash flow and reduce outstanding invoices efficiently.

By ensuring timely follow-ups, automated reminders, and structured collection strategies, businesses can accelerate payments, reduce delays, and maintain a steady cash flow.

Yes, our structured collections process helps recover overdue payments while maintaining positive client relationships. We also provide dispute resolution to minimize delays.

Industries such as healthcare, manufacturing, retail, IT services, and professional consulting benefit from streamlined invoicing and improved collections.

Automation reduces manual errors, speeds up invoicing, sends timely reminders, and provides real-time insights into outstanding payments. This helps businesses reduce DSO (Days Sales Outstanding) and improve efficiency.

Yes, we integrate seamlessly with ERP and accounting systems to ensure a smooth transition and real-time tracking of invoices and payments.

We follow industry best practices, adhere to financial regulations, and implement credit risk analysis to ensure secure and compliant accounts receivable processes.

Blog

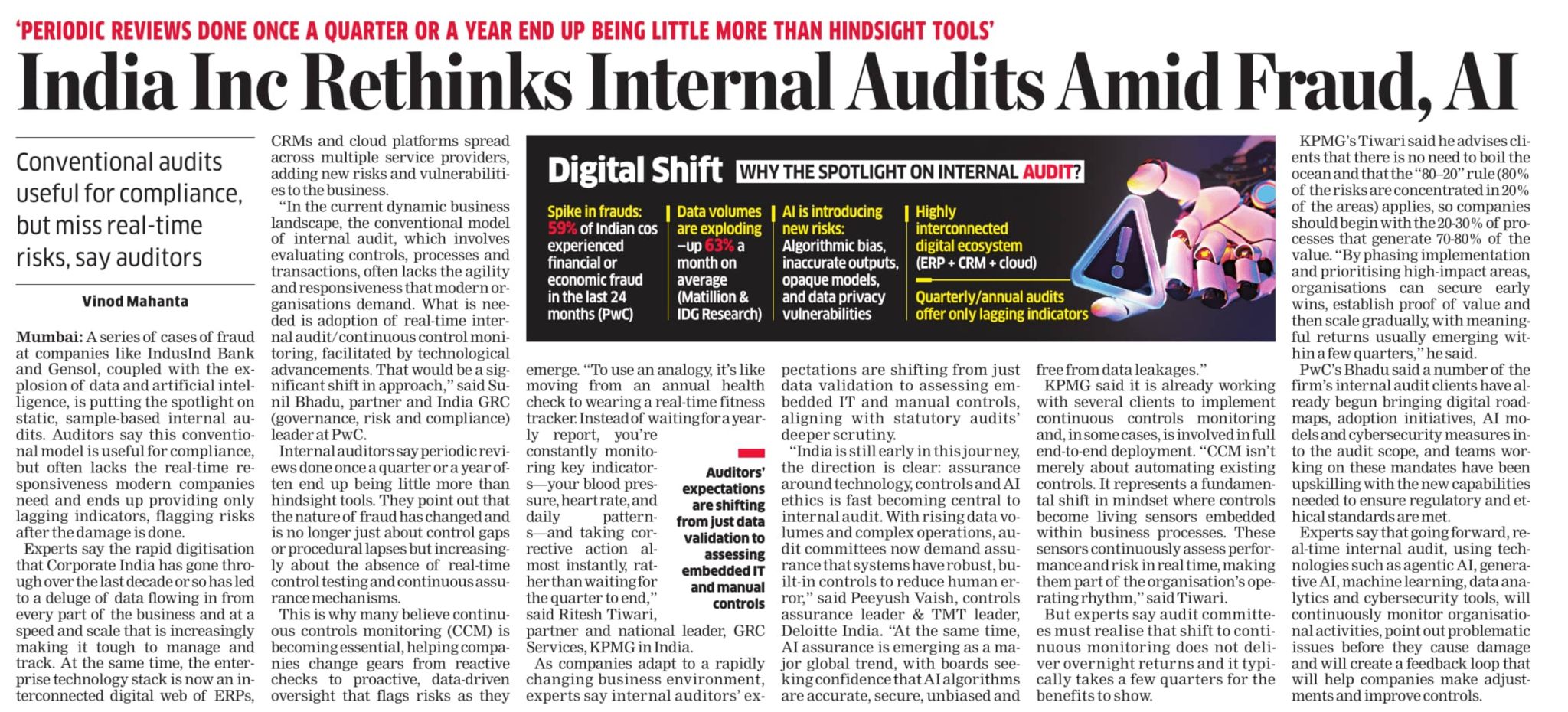

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses

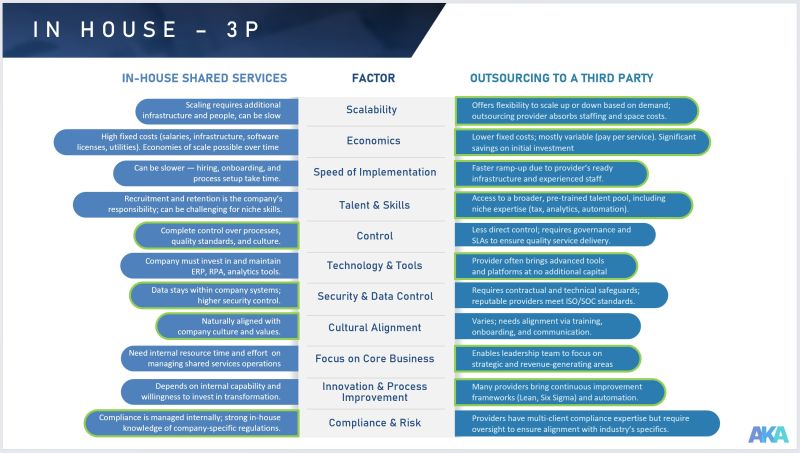

Building a Shared Service Center: The Moment 'You and Us' Became 'We'

“Are you here to take over our jobs?”They never said it, but we could feel it — the polite smiles, t...

Outsourcing, InhouseVsOutsourcing, SharedServices, BusinessTransformation, ProcessOptimization, GrowTogether, TogetherWeDeliver