Key Challenges Businesses Face:

High Processing Costs & Errors

AP automation can reduce invoice errors by up to 90% and cut costs by 80%.

Delayed Approvals & Payments

Without an optimized accounts payable process, payments get stuck in manual bottlenecks.

Compliance & Vendor Issues

A structured accounts payable service ensures timely payments, regulatory compliance, and stronger supplier relationships.

Operational Inefficiencies

Without real-time reporting, businesses struggle to track outstanding payments and forecast expenses.

What We Offer:

Know more about our Accounts Payable Outsourcing Services

How Your Business Will Benefit

AI Based

Invoice Capture

Smart AI invoice capture boosts AP

capture boosts AP

Boost

Efficiency

Early detection of discrepancies

and free up resources.

Stronger Internal

Controls

Minimize fraud & errors

while enhancing financial security.

Better Supplier

Relationships

Consistent, on-time payments

improve vendor trust and negotiation

Frequently Asked Questions

Accounts payable outsourcing is the process of delegating invoice processing, payments, and vendor management to an external provider, improving efficiency and reducing costs.

Yes, we implement advanced security protocols, encryption, and compliance measures to protect your financial data.

No, outsourcing accounts payable ensures timely, accurate payments, strengthening vendor trust and improving relationships.

By eliminating manual processing, paper invoices, and inefficiencies, AP outsourcing can reduce operational costs by up to 80%.

Absolutely! Our AP outsourcing solutions integrate seamlessly with ERP systems like SAP, QuickBooks, and NetSuite.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

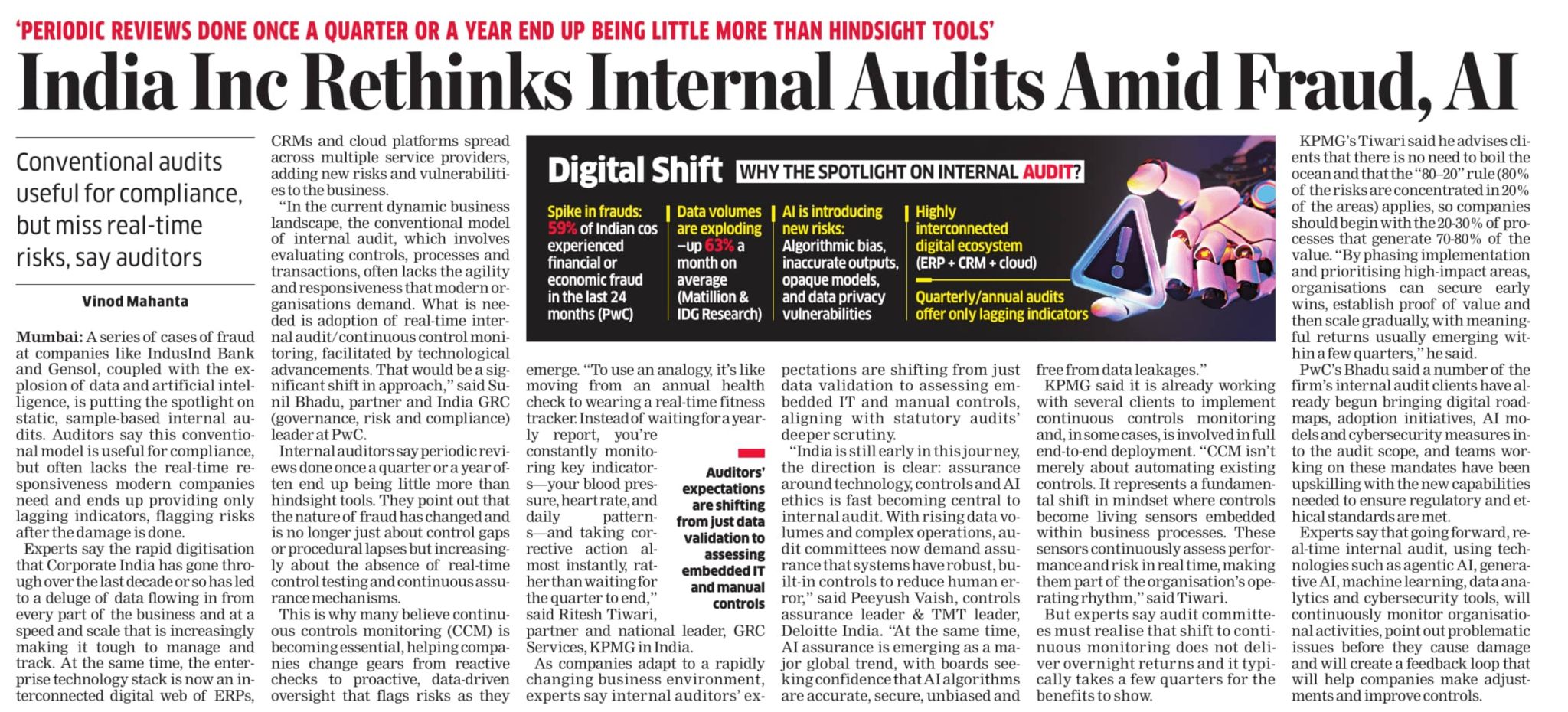

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses