Key Challenges Businesses Face

Hidden Fees & Discrepancies

Unnoticed deductions and miscalculations lead to revenue loss.

Complex Fee Structures

Different commission rates, listing fees, and transaction charges create reconciliation challenges.

Varied Payment Schedules

Inconsistent disbursement cycles make cash flow management difficult.

Manual Errors & System Limitations

Outdated reconciliation methods result in inaccuracies and inefficiencies.

What We Offer

Know more about our Ecommerce ReconciliationServices

How Your Business Benefits

Ensure Financial

Accuracy

Prevent revenue leaks

with precise transaction matching.

Improve Cash

Flow

Enhance Vendor

Trust

Save Time &

Resources

Automate reconciliation and

free up internal teams for strategic

tasks.

Enhance Vendor

Trust

Maintain transparency with

accurate financial reporting.

Frequently Asked Questions

Ecommerce reconciliation is the process of matching marketplace transactions with internal financial records to ensure accuracy. It helps businesses detect hidden fees, prevent revenue leakage, and maintain financial transparency.

We compare sales, fees, commissions, and payouts from multiple ecommerce platforms with your internal records. Automated tools and expert reviews help identify discrepancies, resolve mismatches, and recover lost revenue.

Common discrepancies include incorrect commission charges, hidden fees, missed payments, duplicate transactions, and unauthorized deductions. Our service ensures all transactions align with actual revenue earned.

Yes, we support reconciliation across various marketplaces, including Amazon, Shopify, eBay, Flipkart, and others, ensuring all platform-specific fees and payment schedules are accurately tracked.

We generate detailed reports covering revenue trends, fee breakdowns, outstanding payments, and dispute resolution status, offering a clear financial overview to support business decisions.

Yes, we support reconciliation across various marketplaces, including Amazon, Shopify, eBay, Flipkart, and others, ensuring all platform-specific fees and payment schedules are accurately tracked.

Automation reduces manual errors, speeds up transaction matching, and provides real-time insights. AI-driven tools help detect inconsistencies quickly, improving accuracy and efficiency.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

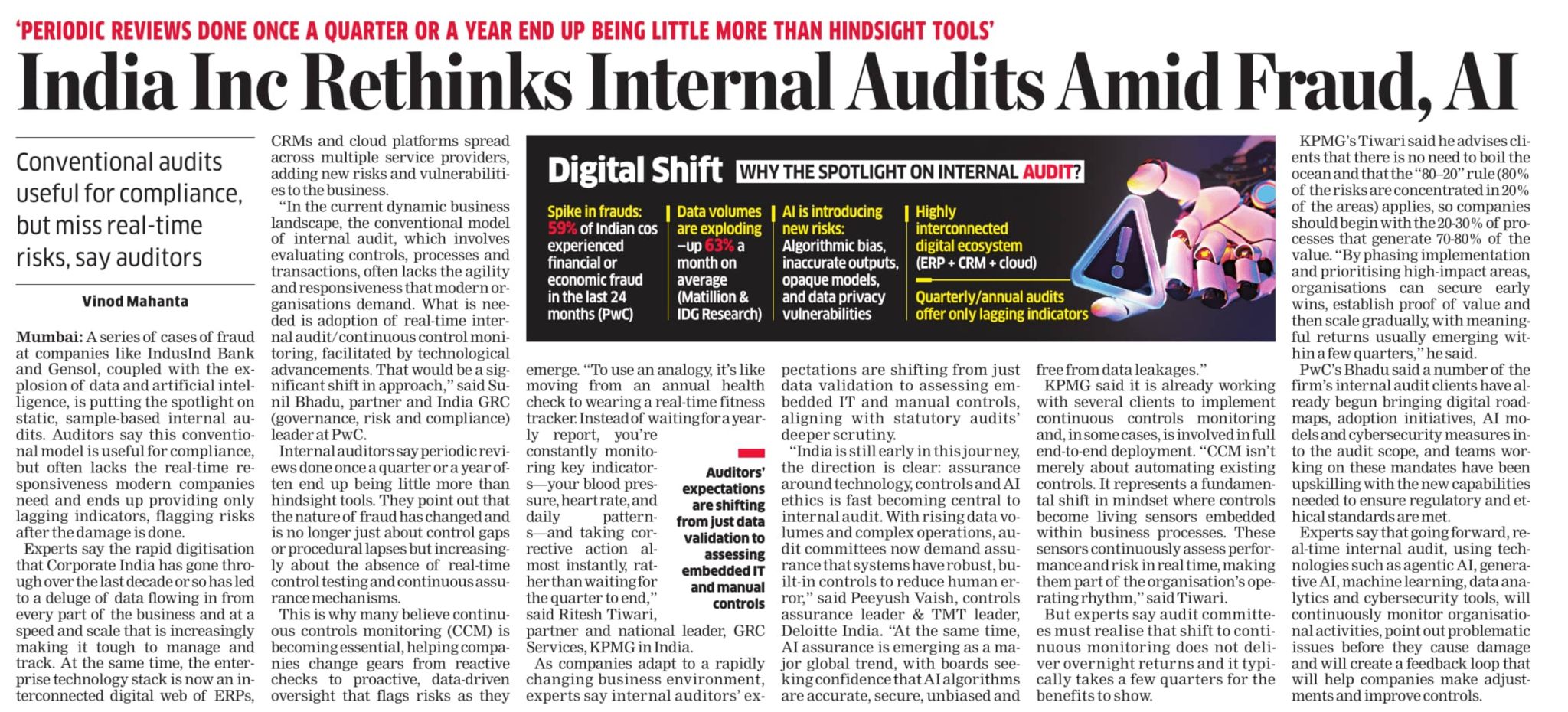

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses