Key Challenges Businesses Face

Unreliable Financial Forecasting

Inaccurate predictions can lead to poor investment decisions and financial instability.

Inefficient Budgeting Processes

A lack of structured budgeting can result in overspending or misallocation of resources.

Limited Performance Tracking

Without real-time financial monitoring, businesses struggle to identify trends and make timely adjustments.

Compliance Risks

Not aligning with financial regulations and accounting standards can lead to penalties and reputational damage.

What We Offer

Know more about our Financial Planning and Analysis Services

How Your Business Benefits

Improved Financial

Clarity

Gain accurate forecasting and

data-backed financial insights to

drive business growth.

Optimized Budgeting &

Resource

Allocation

Effectively plan and

allocate resources to maximize

profitability.

Enhanced Decision-

-Making

Make strategic financial

decisions based on reliable data and

expert analysis.

Regulatory

Compliance

Ensure adherence to financial

laws and accounting standards

with expert guidance.

Frequently Asked Questions

FP&A is a strategic financial management process that includes budgeting, forecasting, performance tracking, and financial reporting to help businesses make informed decisions.

It ensures financial stability, improves decision-making, optimizes budgeting, and helps companies adapt to market changes.

By using data-driven insights, scenario planning, and advanced modeling techniques, FP&A helps businesses create more accurate financial projections.

All industries, including finance, healthcare, retail, manufacturing, and technology, can leverage FP&A for better financial management.

It streamlines budgeting processes, prevents overspending, and ensures efficient resource allocation to maximize profitability.

Yes, FP&A ensures businesses adhere to financial regulations, accounting standards, and compliance requirements, reducing legal risks.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

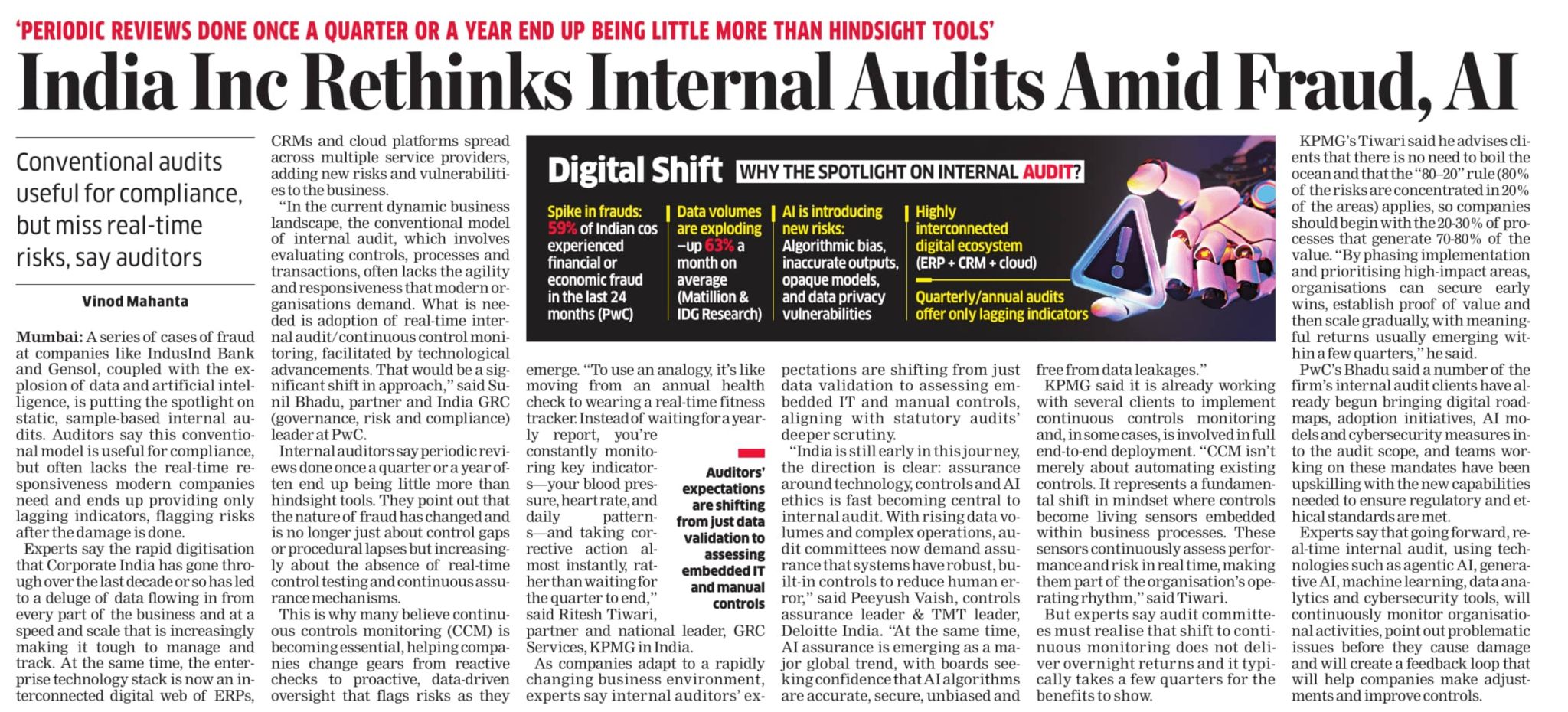

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses