Key Challenges Businesses Face

Inaccurate Asset Valuation

Errors in recording and assessing assets impact financial transparency.

Compliance Risks

Failure to adhere to accounting standards can result in regulatory penalties.

Inefficient CapEx Management

Poor tracking of investments leads to budget overruns and misallocated funds.

Lack of Oversight

Weak approval processes increase the risk of fraud and unnecessary spending.

What We Offer

Know more about our CapEx Audit Services

How Your Business Benefits

Stronger Financial

Oversight

Maintain accurate records

and prevent financial misstatements.

Improved Investment

Efficiency

Ensure capital is allocated

to high-impact projects.

Regulatory

Compliance

Work with trusted

CapEx audit services

to meet accounting

and legal requirements.

Reduced Financial

Risk

Identify fraud, inefficiencies,

and mismanagement early on.

Frequently Asked Questions

A CapEx audit is a thorough review of a company's capital expenditures to ensure they are accurately recorded, strategically allocated, and compliant with accounting regulations. It helps businesses optimize investment efficiency and prevent financial mismanagement.

The audit includes asset valuation, compliance verification, approval processes, expenditure tracking, and financial reporting to ensure capital investments align with business goals.

We assess adherence to accounting standards and regulatory requirements, helping businesses avoid penalties and ensuring financial transparency.

Yes, by evaluating investment tracking and approval processes, the audit helps identify inefficiencies, reduce misallocated funds, and prevent unnecessary spending.

Yes, by evaluating investment tracking and approval processes, the audit helps identify inefficiencies, reduce misallocated funds, and prevent unnecessary spending.

Regular audits, at least annually or before major investments, help businesses maintain financial accuracy and investment efficiency.

The audit provides actionable recommendations for cost optimization, compliance improvements, and better capital allocation strategies.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

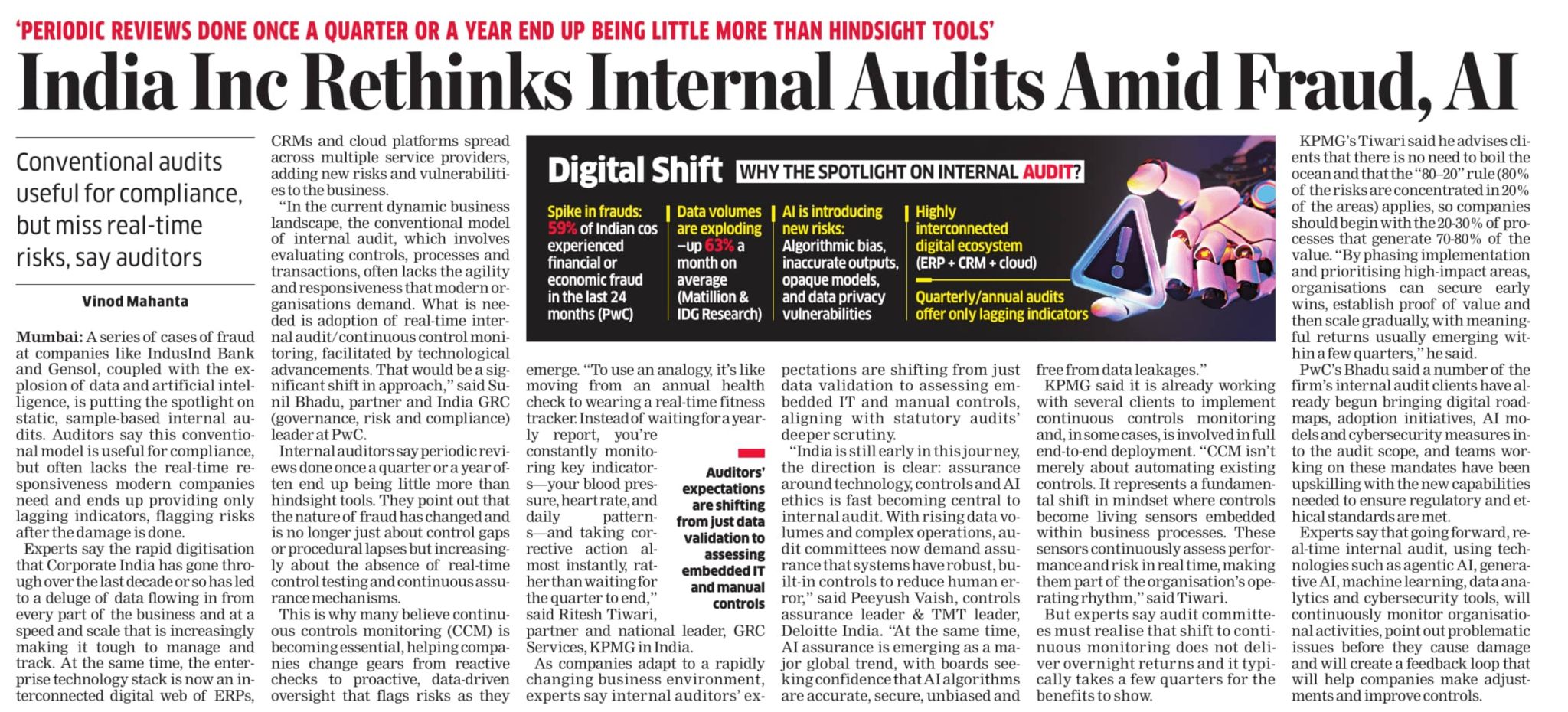

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses