Key Challenges Businesses Face

Data Inaccuracy & Poor Decision-Making

Without structured audits from internal audit firms, leadership decisions may be based on incorrect financial data.

Weak Controls

Poor oversight increases the risk of fraud and financial mismanagement, making internal audit reports essential.

Fraud & Misappropriate Risk

Hidden inefficiencies in cash flow, invoicing, and expense management can cost businesses millions.

Lack of Compliance & Risk Management

Without a strong internal audit process, businesses may unknowingly violate regulations, leading to penalties.

What We Offer

Know more about our Internal Audit Services

How Your Business Benefits

Enhanced Compliance &

Risk

Management

Our internal audit services help prevent

regulatory violations

and financial penalties.

Stronger Internal Control

& Governance

Reduce costs, optimize cash flow, and eliminate waste

with our

detailed internal audit reports.

Fraud

Prevention

Protect your business from fraud and

errors with a structured

internal audit process.

Data-Driven

Decision-Making

Gain transparency into your financial

health with insights from

our internal audit checklist.

Frequently Asked Questions

An internal audit is a systematic review of a company’s financial and operational processes to ensure compliance, risk management, and efficiency. It helps businesses identify weaknesses, improve controls, and prevent fraud.

Internal audits ensure that businesses adhere to industry regulations, tax laws, and financial reporting standards, helping avoid penalties and legal issues

Our internal audit services assess financial records, risk management processes, internal controls, operational efficiency, and regulatory compliance.

The frequency depends on business size, industry, and risk exposure, but many companies conduct audits quarterly, annually, or as needed for compliance.

Yes! A strong internal audit process detects irregular transactions, financial mismanagement, and fraud risks, allowing businesses to take preventive actions.compliance.

Our reports provide detailed insights into financial health, risk assessments, compliance gaps, and recommendations for improving efficiency and controls.

Outsourcing to professional internal audit firms ensures objective analysis, expert insights, cost savings, and industry best practices without the burden of an in-house team.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

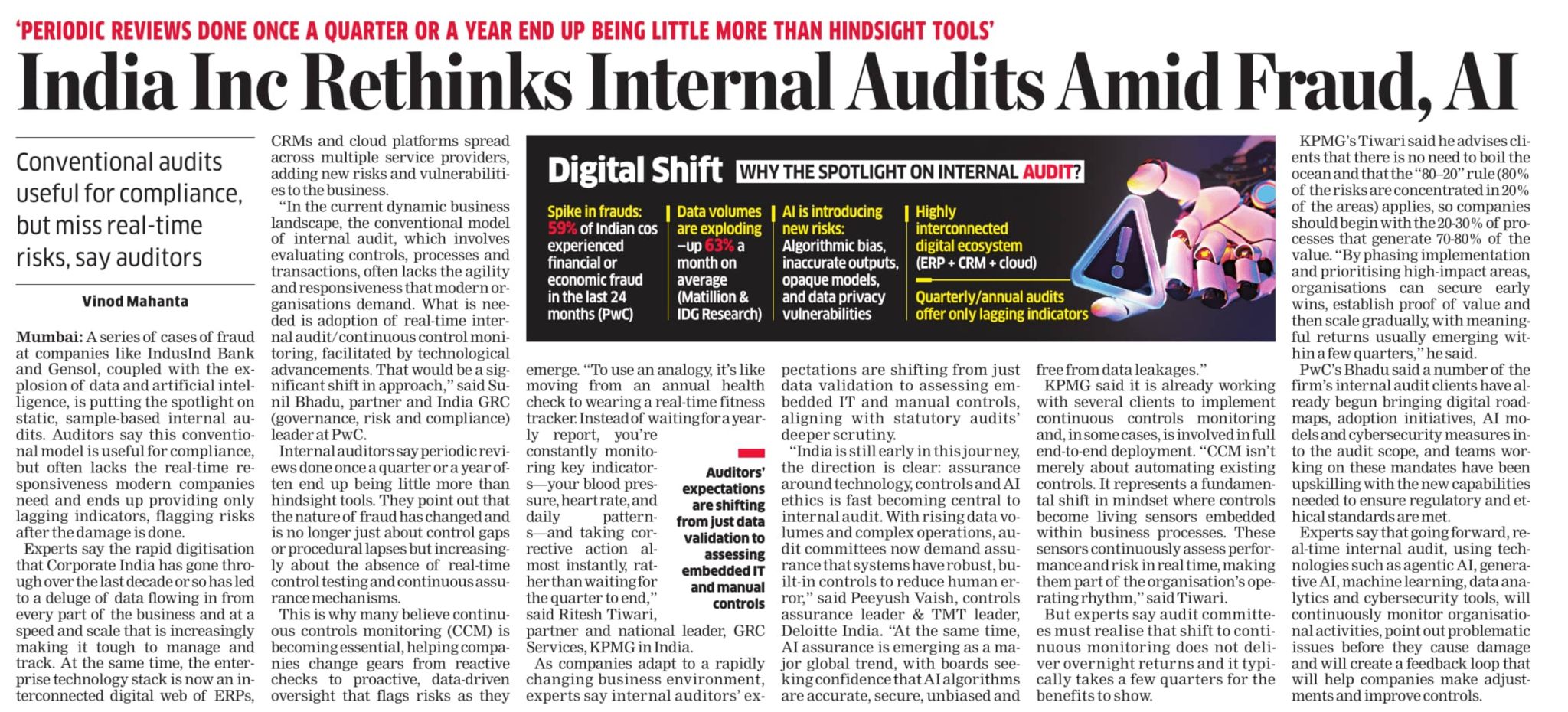

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses