Key Challenges Businesses Face

Data From Multiple System

Without an effective customer reconciliation process, misaligned transactions can cause revenue loss.

Manual Reconciliation- Slow

Manual efforts to reconcile customer accounts slow down operations, affecting cash flow and business efficiency.

Missing / Incorrect Documentation

Poor customer account reconciliation can lead to regulatory non-compliance, legal penalties, and loss of credibility.

Unapplied / Misapplied Payments

A lack of automation in customer reconciliation creates bottlenecks, wasting time and resources.

What We Offer

Know more about our Customer ReconciliationServices

How Your Business Benefits

Accurate Financial

Records

Prevent discrepancies and maintain

precise financial data with our customer reconciliation services.

Increased Operational

Efficiency

Free up resources and

accelerate reconciliation

with automation.

Stronger Client

Relationships

Build trust through accurate

reporting and seamless

transactions.

Compliance &

Risk Reduction

Ensure compliance with legal regulations

through structured customer reconciliation processes.

Frequently Asked Questions

Customer reconciliation is the process of matching transactions between a business and its customers to ensure accuracy, prevent discrepancies, and maintain financial integrity.

Automation reduces manual errors, speeds up transaction matching, and eliminates bottlenecks, leading to faster and more accurate reconciliation.

Any business handling large volumes of customer transactions, including retail, finance, SaaS, and service-based industries, benefits from reconciliation to ensure accurate records.

Yes! Proper reconciliation ensures regulatory compliance, reduces audit risks, and prevents legal penalties by maintaining transparent financial records.

By detecting errors, duplicate entries, and missing payments, reconciliation helps businesses recover lost revenue and prevent financial mismanagement.

Absolutely! Accurate financial records reduce billing disputes, ensure timely corrections, and build trust with customers.

The frequency depends on transaction volume, but businesses typically reconcile monthly, quarterly, or in real-time using automated solutions for optimal accuracy.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

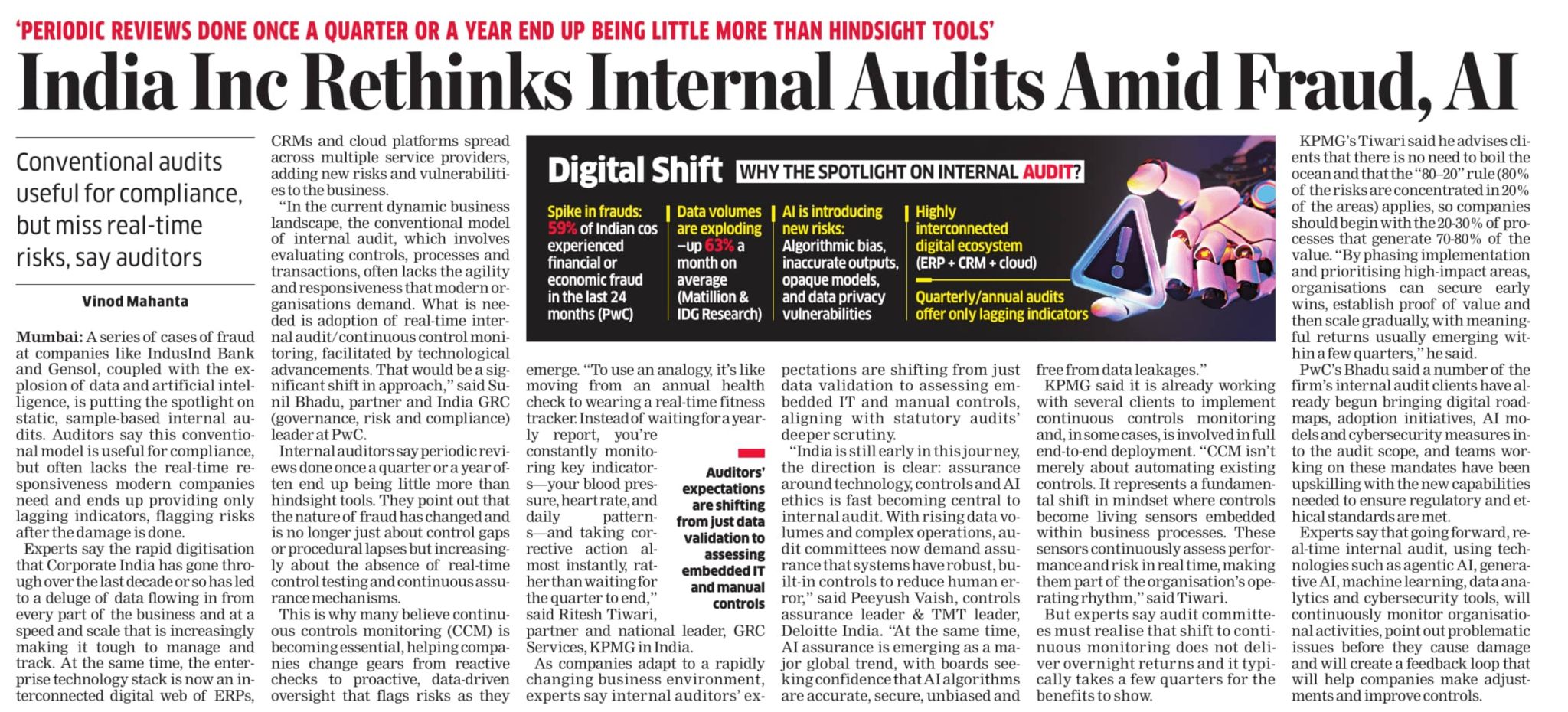

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses