Key Challenges Businesses Face

High Transaction volumes & Complexity

Manual audits done periodically are not sufficient and also not effective as transaction volumes are high across multiple systems and locations.

Delayed Error & Fraud Detection

Losses, fraud, leakages, errors and instances of non-compliance are identified after they occur or in many cases go un noticed.

Limited Real-time Visibility & Control

Lack of actionable insights from daily transactions, control lapses and policy deviations

Cost Leakage and Compliance Risk

Duplicate payments, unauthorized pricing, policy breaches, and regulatory non-compliance silently erode profitability and increase exposure.

What We Offer

Know more about our Continuous Transaction MonitoringServices

How Your Business Benefits

Early Fraud Detection

& Loss Prevention

Monitor financial transactions

24/7 for suspicious activity.

Regulatory

Compliance

Stay ahead of evolving

financial laws.

Proactive

Risk Mitigation

Catch issues before

they escalate.

AI-Powered

Efficiency

Reduce manual workload

and human errors.

Frequently Asked Questions

Continuous transaction monitoring is the real-time analysis of financial transactions to detect fraud, compliance breaches, and suspicious activity before they cause harm.

It helps businesses prevent fraud, comply with financial regulations like AML and KYC, and mitigate risks before they escalate.

AI-powered monitoring detects complex fraud patterns, reduces false positives, and provides real-time alerts for faster response.

Banks, fintech companies, e-commerce platforms, insurance firms, and other financial institutions rely on transaction monitoring for security and compliance.

Yes, it ensures businesses meet AML (Anti-Money Laundering), KYC (Know Your Customer), and other financial compliance requirements.

Real-time monitoring identifies suspicious transactions instantly, whereas traditional methods often detect fraud after it has occurred.

It can identify identity theft, money laundering, unauthorized transactions, payment fraud, and other financial crimes.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

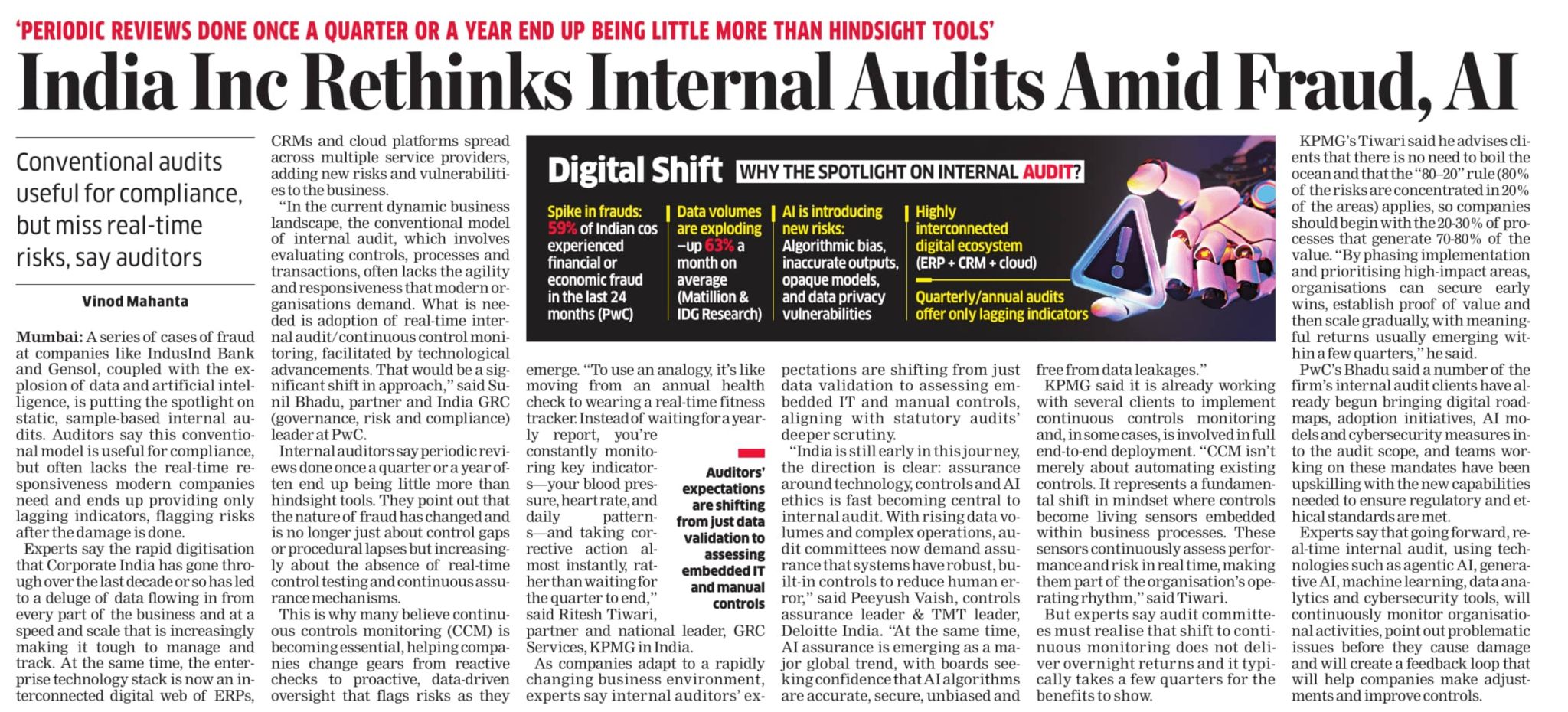

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses