Key Challenges Businesses Face

Revenue Leakage

Unnoticed billing errors, incorrect pricing, and lost transactions impact profitability.

Compliance Risks

Inaccurate financial reporting and non-compliance with regulations lead to penalties.

Inefficient Billing Processes

Errors in invoicing, contract mismanagement, and delayed payments affect cash flow.

Data Inconsistencies

Manual errors and outdated systems cause discrepancies in financial records.

What We Offer

Know more about our Revenue Assurance Audit Services

How Your Business Benefits

Prevent Revenue Loss

Improved

Compliance

Identify and fix leaks to maximize

earnings and improve financial

health.

Ensure Regulatory

Compliance

Stay aligned with financial and

tax regulations, avoiding costly

fines.

Optimize Billing &

Collections

Reduce errors, improve invoicing

accuracy, and enhance cash flow.

Enhance Financial

Transparency

Gain deeper visibility into revenue

streams for better

decision-making.

Frequently Asked Questions

A revenue assurance audit is a detailed review of your financial processes, billing systems, and revenue streams to detect and correct errors that could lead to lost income. It ensures accurate financial reporting and compliance.

By identifying billing errors, incorrect pricing, and missed transactions, a revenue assurance audit helps recover lost revenue and prevent future losses.

Revenue assurance audits are valuable for telecommunications, finance, retail, healthcare, utilities, and subscription-based businesses, where billing accuracy and revenue tracking are critical.

Regular audits—quarterly, bi-annually, or annually—help businesses identify issues early and maintain financial accuracy. The frequency depends on the size and complexity of your financial operations.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

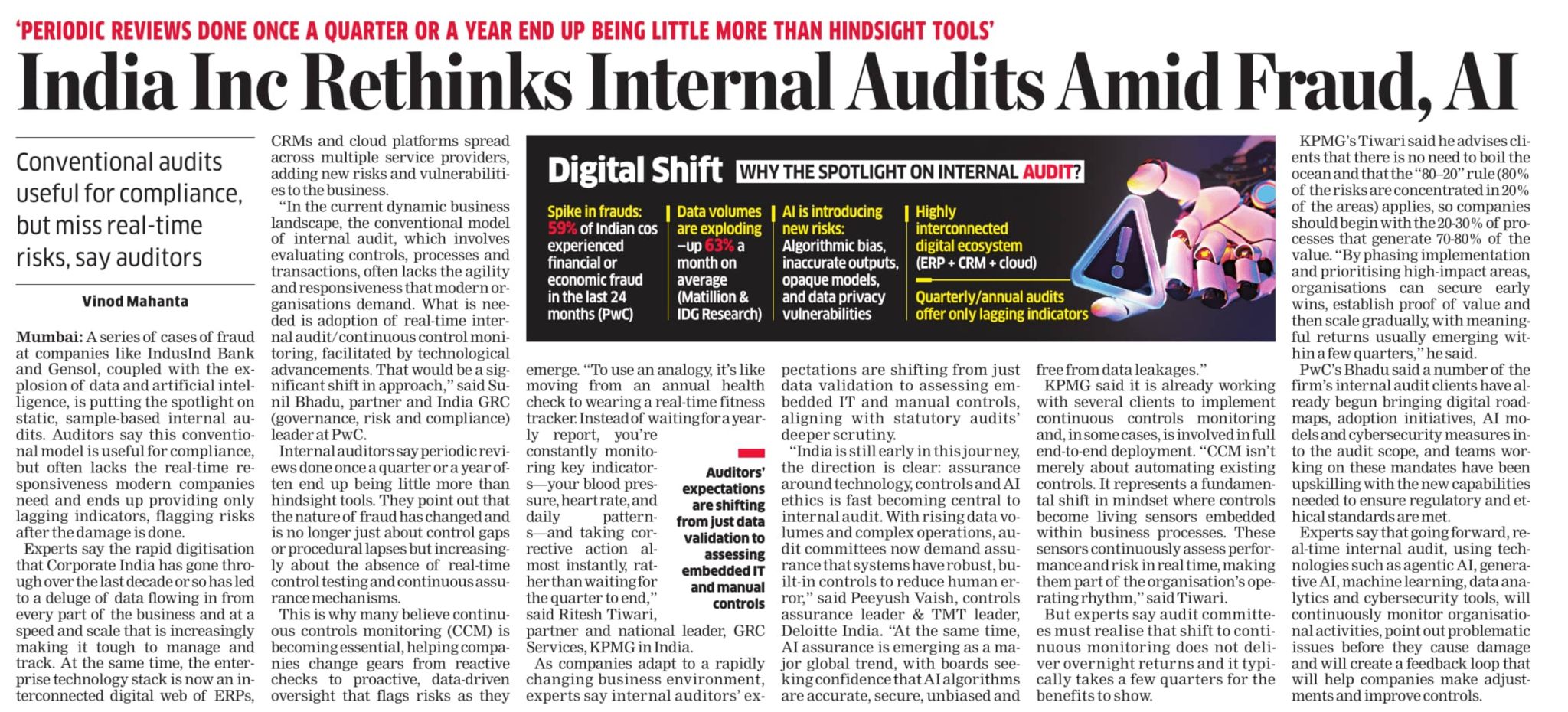

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses