Key Challenges Businesses Face

Unnecessary or Inflated Fees

Payment processors often charge hidden or excessive fees that go unnoticed.

Errors in Processing Statements

Incorrect charges and billing mistakes can lead to financial losses.

Lack of Transparency in Payment Costs

Many businesses struggle to understand complex processing fees.

Compliance & Security Risks

Non-compliance with regulations like PCI DSS can result in penalties.

What We Offer

Know more about our Merchant Audit Services

How Your Business Benefits

Significant Cost

Savings

Eliminate hidden fees

and reduce payment processing expenses.

Improved Financial

Planning

Gain full clarity

on your payment

processing costs.

Operational

Efficiency

Streamline payment

systems for smooth, hassle-free transactions.

Regulatory

Compliance

Stay compliant with

PCI DSS and avoid

costly penalties.

Frequently Asked Questions

A merchant audit is a detailed review of your credit card processing statements to identify hidden fees, errors, and overcharges. Businesses need it to ensure they are not overpaying on processing fees and to optimize their payment costs.

Common hidden fees include unnecessary surcharges, inflated interchange rates, non-compliance penalties, and duplicate charges. Our audit helps businesses eliminate these costs and negotiate better rates.

We conduct a line-by-line analysis of your processing statements, compare fees with industry benchmarks, and identify any excessive charges. We then provide recommendations for cost savings and help negotiate better terms with payment processors.

Yes, we assess compliance with PCI DSS and other regulatory standards to help businesses avoid penalties and maintain secure payment processing.

No, the audit is a review of your current processing setup. We do not disrupt your payment processing but provide insights on optimizing costs and improving transparency.

It’s recommended to conduct an audit at least once a year to catch any new fees, rate increases, or changes in processing terms. Regular audits ensure ongoing cost efficiency.

Savings vary depending on your current processing fees and structure, but businesses often see significant reductions in hidden charges and better-negotiated rates, leading to long-term cost savings.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

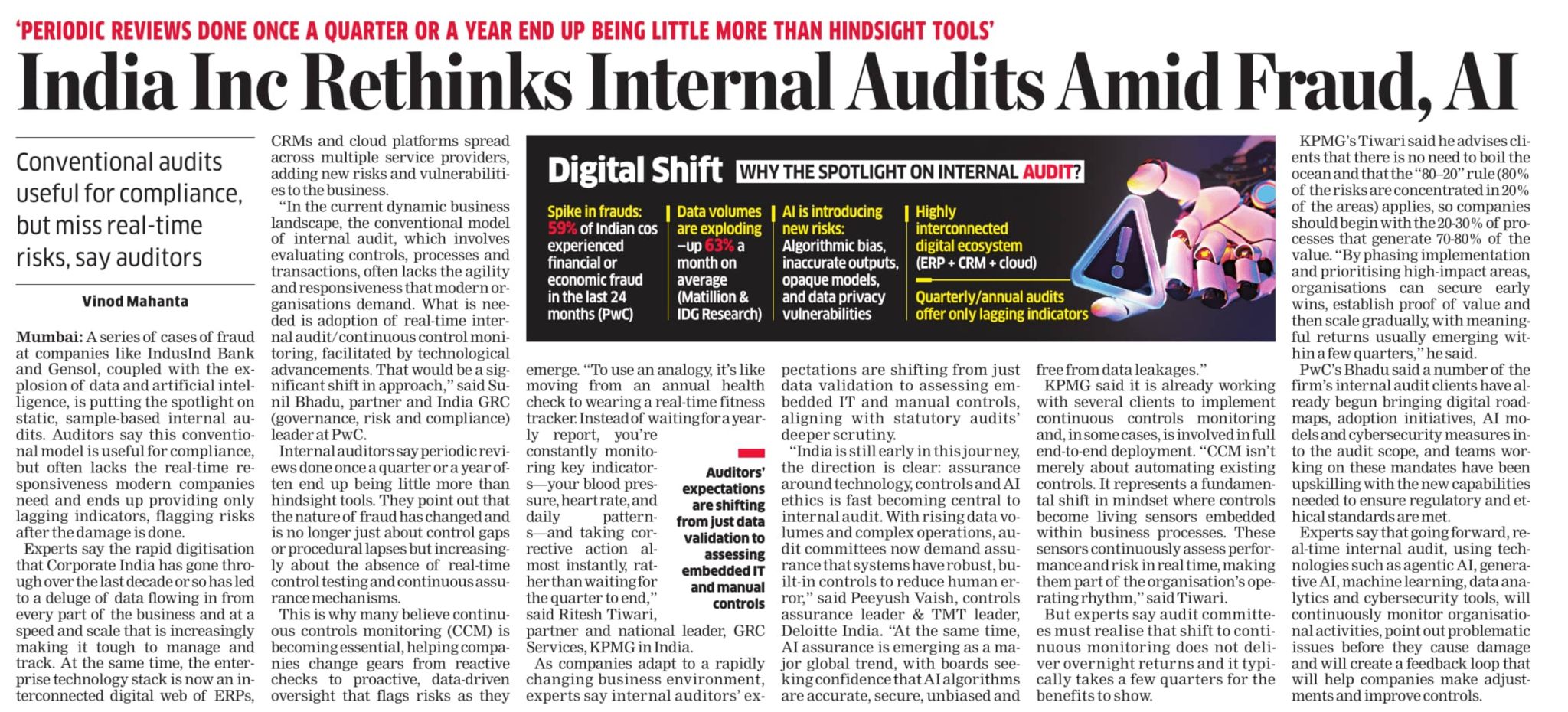

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses