Key Challenges Businesses Face

Unnoticed Duplicate Payments

Busy accounting teams often miss double payments hidden in complex data.

Inadequate Duplicate Payment Reviews

Without regular, detailed reviews, overpayments can go unnoticed for months.

Delayed Duplicate Payment Recovery

Late discovery makes it harder to recover funds from vendors or offset in future billing.

Lack of Systems to Prevent Duplicate Payment

Many firms lack clear internal controls or automation that flags duplicates before they occur.

What We Offer

Know more about our Duplicate Payment Reviews Services

How Your Business Benefits

Instant Financial

Recovery

Quick identification and action

on overpayments brings

back lost funds to your bottom line.

Improved Process

Accuracy

Refined payables workflows help

reduce future errors and streamline operations.

Better Vendor

Relationships

Clear and accurate reconciliation

builds trust and credibility

with suppliers.

Stronger Internal

Controls

Regular duplicate payment audits

build a culture of financial discipline and accountability.

Frequently Asked Questions

A duplicate payment audit identifies instances where a payment has been made more than once for the same invoice or service and helps in recovering the funds.

Regular reviews prevent unnoticed financial leakage and ensure your accounts payable system remains accurate and efficient.

Once duplicates are confirmed, we reach out to vendors on your behalf to initiate refunds, credits, or adjustments.

Yes, we recommend best practices, internal controls, and tools to help detect and prevent duplicates before payments are made.

We use a combination of manual analysis and specialized software to identify suspicious payment patterns and duplicates.

Ideally, reviews should be quarterly or semi-annually, especially for high-volume businesses.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

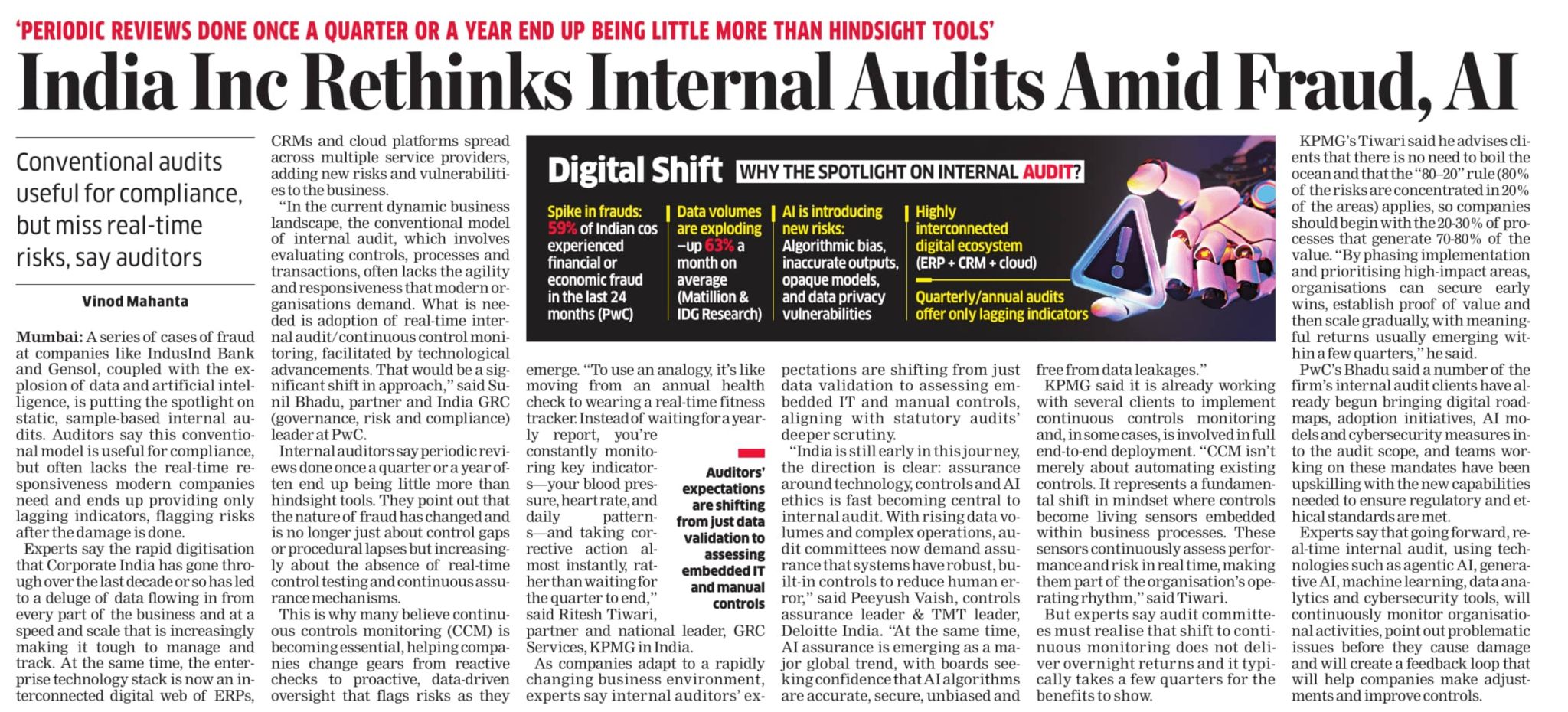

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses