Key Challenges Businesses Face

Regulatory Compliance Risks

Failure to meet industry standards or maintain proper documentation for distributor claims can result in penalties and reputational damage.

Operational Inefficiencies

Poor distributor management causes delays and increased costs.

Financial Discrepancies

Hidden costs, inaccurate records, and unverified distributor claims directly impact profitability.

Process & Quality Issues

Lack of oversight leads to product inconsistencies and inefficiencies.

What We Offer

Know more about our Distributor Audit Services

How Your Business Benefits

Reduced Risks &

Errors

Identify and resolve compliance, financial

inaccuracies, and

incorrect claims settlements early.

Stronger Compliance

Framework

Work with trusted

Distributor Audit Companies

for peace of

mind.

Optimized Supply

Chain

Improve distributor efficiency

and eliminate

bottlenecks.

Accurate Financial

Oversight

Maintain clear financial

records with expert

guidance.

Frequently Asked Questions

A distributor audit is a comprehensive assessment of distributor operations, claims management, compliance, and financial accuracy. It helps businesses identify inefficiencies, mitigate risks, and ensure distributors adhere to industry regulations.

Our audit covers compliance verification, financial assessments, distributor claims audit, operational efficiency, quality control, and risk management to ensure distributors meet business standards.

We evaluate distributor activities against industry regulations and legal requirements, ensuring compliance and helping businesses avoid penalties or reputational risks.

Yes, by identifying operational inefficiencies and process gaps, the audit helps optimize supply chain workflows, reduce delays, and improve distributor performance.

Yes, by identifying operational inefficiencies and process gaps, the audit helps optimize supply chain workflows, reduce delays, and improve distributor performance.We analyze transaction records, hidden costs, pricing discrepancies, and contract compliance to ensure financial transparency and prevent revenue loss.

Regular audits, at least annually or biannually, help businesses maintain compliance, financial accuracy, and operational efficiency across distributor networks.

Businesses receive actionable recommendations for process improvements, cost optimization, and compliance enhancements to strengthen distributor relationships and overall performance.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

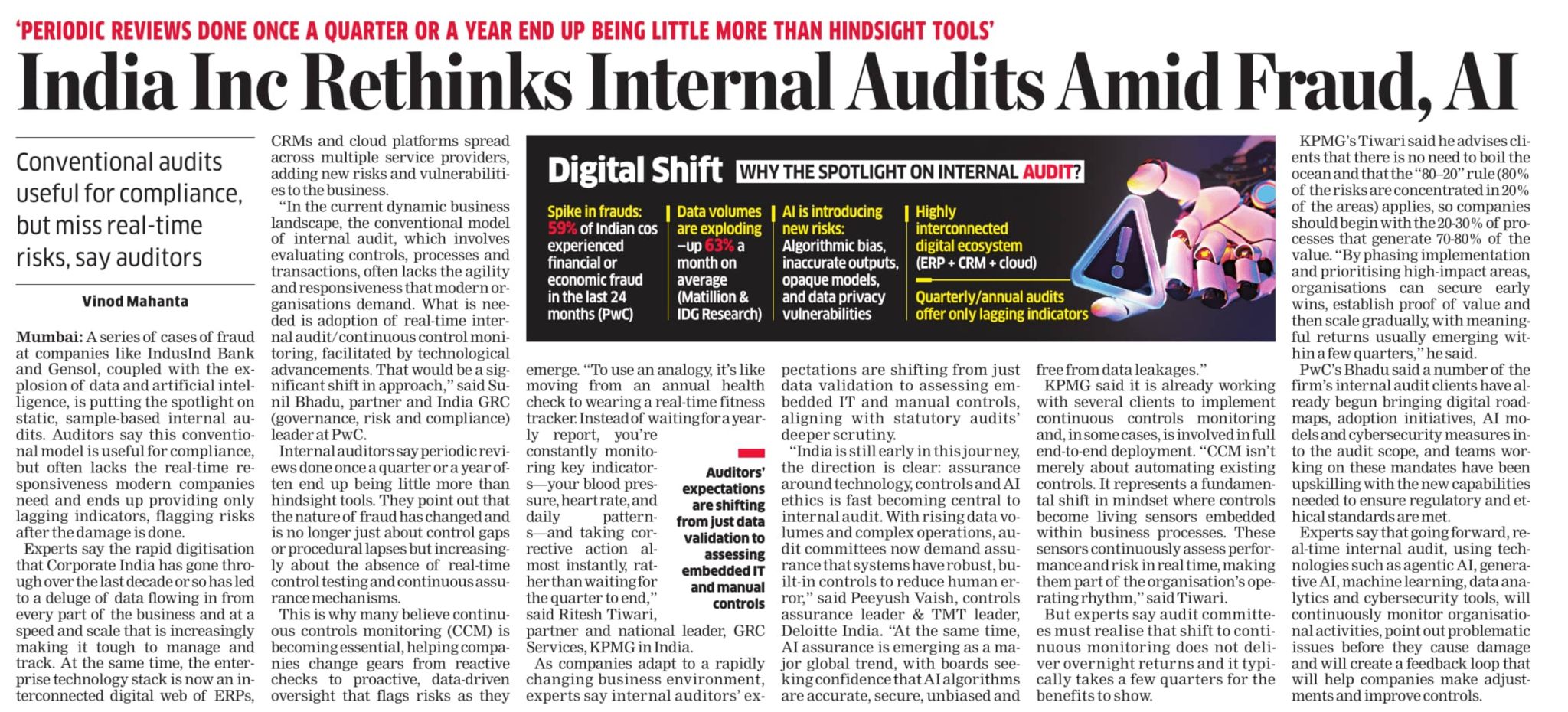

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses