Key Challenges Businesses Face

Controls Exist on Paper but Not in Practice

Many organizations have documented policies and controls, but real-world execution often differs. Controls may be inconsistently applied, outdated, or bypassed due to operational pressures.

Limited Visibility into Key Business Risks

Risk assessments are often high-level and infrequent, making it difficult to understand emerging risks across processes, systems, and geographies.

Reactive Reviews Instead of Proactive Assurance

Traditional audits and reviews are periodic, meaning control weaknesses are discovered after issues occur—leading to financial loss, compliance breaches, or reputational damage.

Resource and Skill Constraints

Risk and control reviews require specialized knowledge across finance, operations, IT, and compliance, which many teams struggle to maintain internally at scale.

What We Offer

Know more about our Continuous Transaction MonitoringServices

How Your Business Benefits

Early Fraud Detection

& Loss Prevention

Early identification of control

weaknesses and risk exposure

Regulatory

Compliance

Reduced financial losses,

fraud risk, and compliance issues

Proactive

Risk Mitigation

Stronger governance and

management confidence

AI-Powered

Efficiency

Cost-effective access to specialized

risk and control expertise

Frequently Asked Questions

It is an independent, structured review of an organization’s key risks and internal controls to assess whether controls are well-designed and operating effectively.

Unlike audits, Risk & Control Reviews are advisory in nature—focused on improvement, proactive risk management, and strengthening controls rather than compliance checks alone.

Finance, revenue assurance, procurement, payments, inventory, IT controls, compliance processes, and other critical business functions.32

It can be delivered as a one-time diagnostic review or as an ongoing periodic service based on your risk profile and business needs.

CFOs, Chief Risk Officers, Internal Audit Heads, Compliance Leaders, and Business Heads seeking independent assurance and control clarity.

Real-time monitoring identifies suspicious transactions instantly, whereas traditional methods often detect fraud after it has occurred.

It can identify identity theft, money laundering, unauthorized transactions, payment fraud, and other financial crimes.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

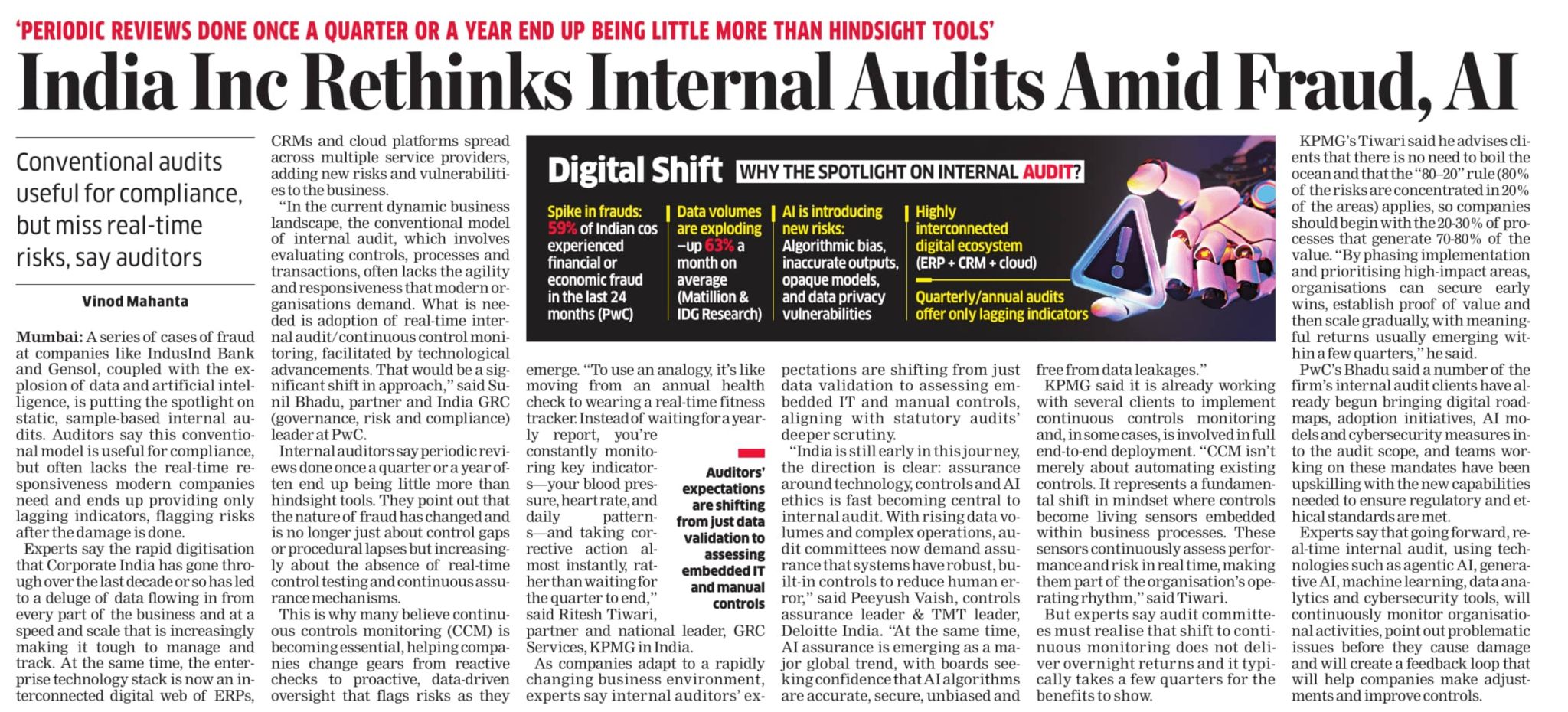

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses