Key Challenges Businesses Face

Fraud Detected Too Late

Most fraud cases are uncovered months after occurrence—often during audits or whistleblower complaints. Delayed fraud detection increases financial losses, weakens recovery chances, and damages organizational credibility.

Evolving & Sophisticated Fraud Schemes

Fraudsters continuously adapt, using collusion, system manipulation, and data exploitation. Rule-based or manual checks fail to keep pace with complex, multi-layered fraud patterns.

Limited Visibility Across Systems & Processes

Transactional data is spread across ERP, billing, procurement, payroll, and third-party platforms. Lack of integrated monitoring makes it difficult to identify red flags across the full fraud lifecycle.

Resource & Skill Constraints

Many organizations lack dedicated fraud analytics expertise and investigative capacity. Internal teams are often overburdened, resulting in weak preventive controls and reactive responses.

What We Offer

Know more about our Continuous Transaction MonitoringServices

How Your Business Benefits

Early Detection

& Loss Prevention

Identify fraud before

it escalates

Reduced Financial

Leakage

Protect revenue

and margins

Stronger Internal

Controls

Move from reactive to

preventive fraud management

Improved Compliance

& Governance

Align with regulatory

and audit expectations

Frequently Asked Questions

The service covers internal fraud, external fraud, collusion, vendor fraud, payroll fraud, expense abuse, revenue leakage, and management override across key business processes. The services include reviews for fraud prevention and/ or fraud detection.

It is typically delivered as an ongoing, continuous service, though targeted one-time fraud reviews can also be performed based on risk priorities.

Traditional audits are periodic and sample-based, while our service uses continuous, data-driven monitoring to detect fraud early and across 100% of transactions.

No. We work with your existing ERP and transaction systems using secure data extracts or connections, with minimal operational disruption.

We support investigation and validation, working closely with your management, legal, HR, or internal audit teams as required.

Yes. Fraud scenarios, analytics, and monitoring frequency are tailored to your industry, transaction volumes, and specific risk areas.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

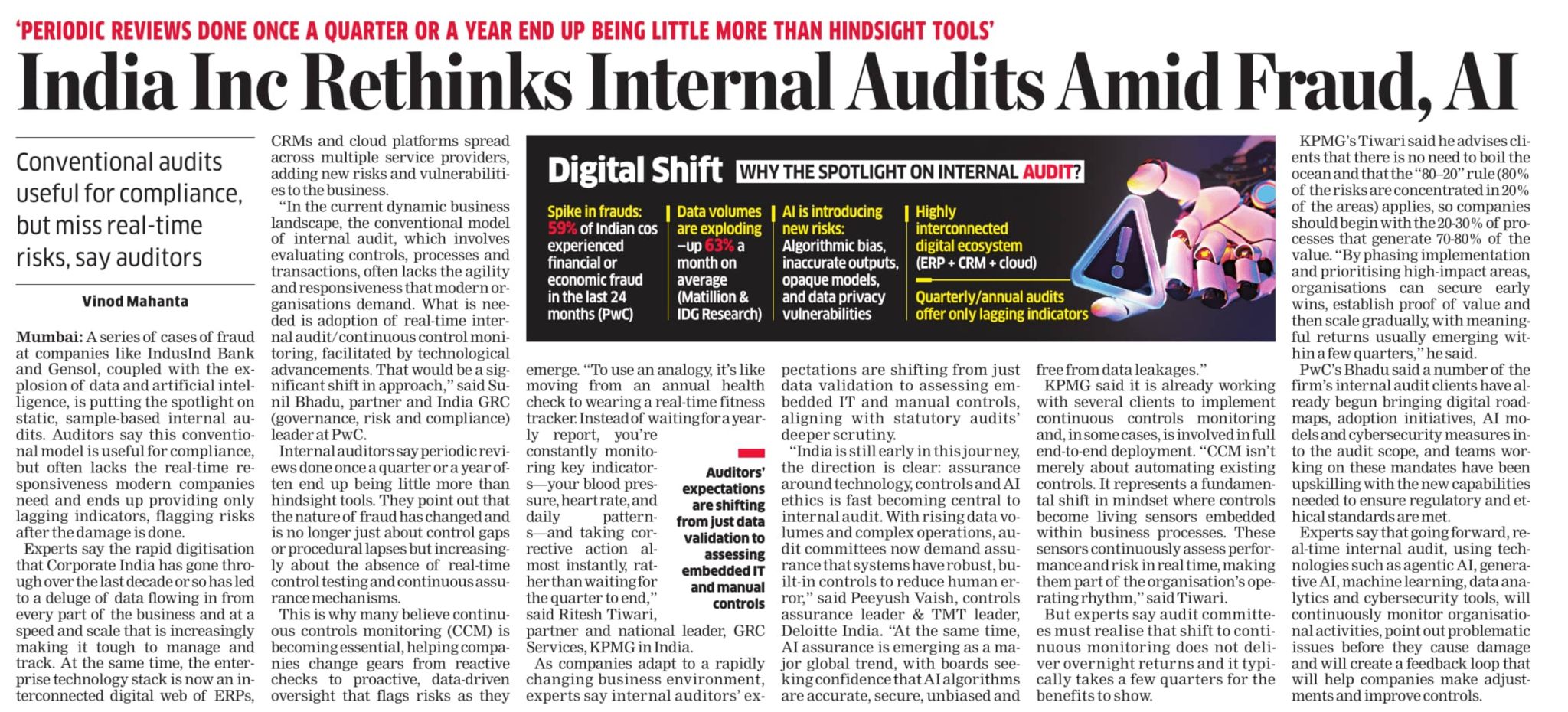

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses