Key Challenges Businesses Face

Control Breakdowns Detected Too Late

Most organizations rely on periodic reviews and audits that identify issues months after they occur. By then, financial loss, non-compliance, or fraud may already have escalated.

Delayed Error & Fraud Detection

Millions of transactions processed across ERP, CRM, billing, payroll, and payment systems overwhelm manual controls and traditional audit methods.

Limited End-to-End Visibility Across Systems

Siloed systems prevent seamless tracking of transactions across the full process lifecycle, creating blind spots where control failures go unnoticed.

Increasing Fraud, Compliance & Audit Pressure

Weak controls around pricing, discounts, refunds, vendor payments, and journal entries increase fraud exposure and make consistent regulatory compliance difficult.

What We Offer

Know more about our Continuous Transaction MonitoringServices

How Your Business Benefits

Early Detection of

Control Failures

Issues are identified in near real-time, reducing

financial loss and operational disruptions.

Reduced Fraud &

Revenue Leakage Risk

Continuous transaction monitoring

services acts as a strong

deterrent and detection mechanism.

Improved Compliance &

Audit Readiness

Stronger controls, better

documentation,

and fewer audit findings.

Operational Efficiency &

Cost Savings

Automation reduces manual

reviews,

rework, and audit effort.

Frequently Asked Questions

It is the ongoing monitoring of key business controls using data analytics to detect control failures, anomalies, and potential risks in real time.

Audits are periodic and sample-based. Continuous Control Monitoring solutions reviews 100% of transactions continuously, enabling proactive risk management.

Common processes include order-to-cash, procure-to-pay, payroll, inventory, fixed assets, revenue recognition, and journal entries.

Continuous control monitoring tools operates in parallel using read-only data access and does not interfere with business operations.

Initial exceptions and insights are typically identified within 4–6 weeks, with ongoing benefits through continuous monitoring.

Yes. The solution easily scales across geographies, systems, and increasing transaction volumes.

CFOs, Internal Audit teams, Risk & Compliance leaders, and large enterprises with complex, high-volume operations.

Blog

Why Automated Vendor Reconciliation Is No Longer Optional for Retail, FMCG & Modern Trade

Vendor reconciliation often runs quietly in the background. Invoices are posted. Payments are...

vendor reconciliation, vendor accounts reconciliation, vendor reconciliation service, vendor reconciliation company in india

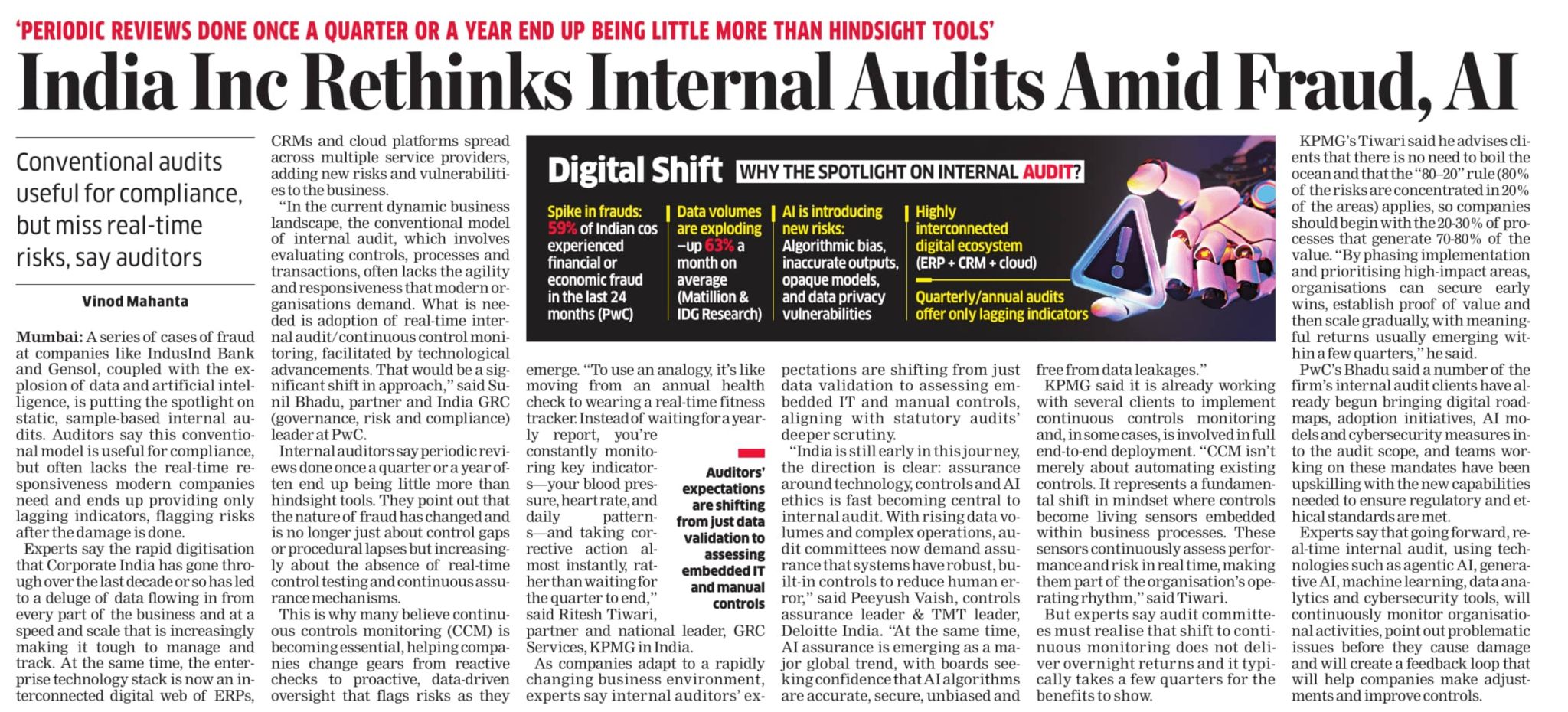

India Inc is Rethinking Internal Audits: But We’ve Been Doing This for Years !

Today’s article in The Economic Times highlights an important truth: periodic, sample-based a...

Internal Audit Services, Internal Audit Firm in India, Internal Audit Company, Internal Audit Outsourcing, Internal Audit Process

Common Challenges in in-house Accounts Payable Management and How Aka Helps Fix Them

Accounts Payable problems rarely announce themselves.Invoices get processed. Payments go out. Vend...

accounts payable automation,workflow optimization,ap process improvement,vendor management,finance automation,accounts payable efficiency,audit firm services,invoice processing solutions,cash flow management,ap automation for businesses